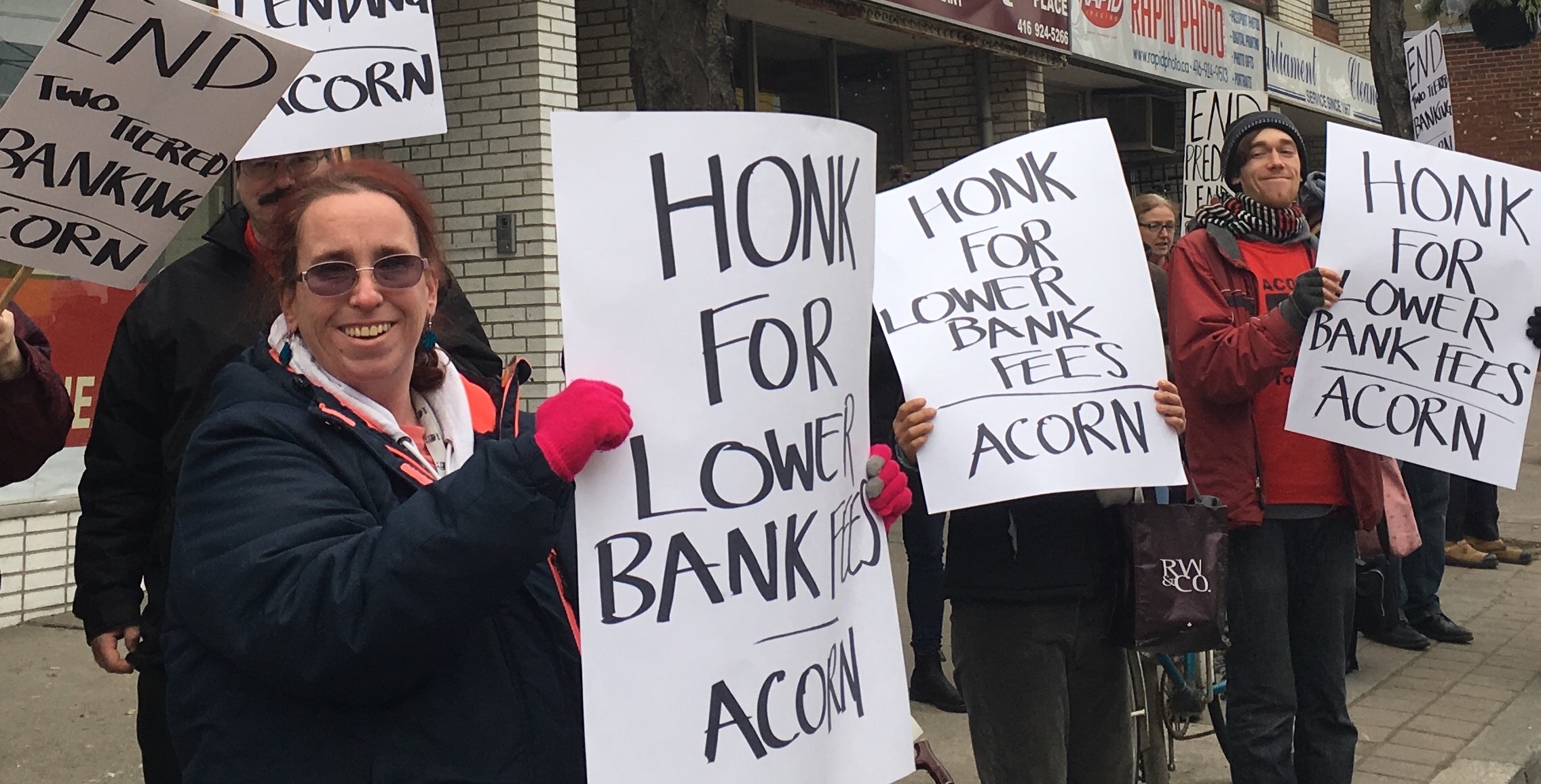

“We say ‘More,’ he says ‘No!,’ Mor-neau, Mor-neau!” I yelled, along with my fellow ACORN members outside Finance Minister Bill Morneau’s constituency office in Toronto this morning. As cars honked in support, we demanded that the Minister improves the consumer protection framework under the Bank Act, so that people on lower-incomes can have access to fair financial services. Our National Day of Action on Fair Banking saw ACORN members taking to the streets in New Westminster, Calgary, Regina, Toronto, Hamilton, Mississauga, Ottawa, Montreal and Halifax, urging the Government to take action. The Bank Act is currently under review, providing an opportunity for the Liberals to implement regulations that meet the needs of their citizens, and we want to make sure they do so.

ACORN’s Fair Banking campaign is important to me. I joined ACORN in 2014 after I ran into problems with a CitiFinancial installment loan (now Fairstone). At the time, I had approached my bank to consolidate my loan payments, to make it easier to repay. However, the bank told me that I had too much credit. Not that I had bad credit, just too much. So they wouldn’t offer me a loan. Left with no alternative, I signed up for a $10,000 loan with Citifinancial. The interest rate was under the 60 per cent permissible by under the Criminal Code. Yet, with the addition of thousands of dollars of insurance premiums, I soon realized it was going to be impossible to pay the loan back. I reached a point where I had repaid $25,000 for a $10,000 loan and CitiFinancial were still saying I owed money.

After searching every corner of the internet to find out how I could resolve this issue, I found that there are little consumer protections in place to protect people like me from these unscrupulous lenders. I reached out to ACORN and found that there are many others in a similar situation — the Government isn’t doing their duty to protect low-income people. While wealthy Canadians can access affordable loans, low and moderate-income Canadians are being denied access to basic credit by mainstream banks. At a time where Canadians are racking up debt-to-income at rate of 169.9 per cent, an increase of over 93 per cent since 1990 (according to Statistics Canada), more and more low-income earners are being pushed into relying on fringe financial services, that charge predatory rates.

Our Fair Banking campaign calls for the Federal Government to mandate the banks to provide access to fair financial services for low and moderate-income earners, including:

- Access to low-interest credit for emergencies;

- Access to low-interest overdraft protection;

- No holds on cheques;

- Lower NSF fees from $45 to $10;

- Alternatives to predatory lenders, such as postal banking and credit union credit products geared toward low and moderate income families;

- Creation a national anti-predatory lending strategy;

- A real-time national tracking system (or database) to help stop roll over loans;

- Amend the Criminal Code to lower the maximum interest rate from 60 per cent to 30 per cent.

Until now, Morneau’s focus when regulating the banks has only served to push low-income communities further to the fringes. Recent changes to mortgage regulation look to make it even more difficult for low-income earners to access credit from mainstream financial institutions. The mortgage rate stress test was introduced to ensure that consumers can afford to borrow, yet by not moving forward on a regulatory framework that addresses the entire market, specifically the absence of a national anti-predatory lending strategy, Morneau has missed the mark.

The stress test only succeeds in raising the bar even higher for low and moderate-income earners who strive to own a home. Even the banks admit that, “If you tighten rules and raise the bar on getting a mortgage from financial institutions, it may prompt a number of borrowers who are being shut out to deal with lenders that are in the less regulated space.” In the midst of a housing crisis, this will push consumers further into the fringes and increase the risk that borrowers will get trapped in high-interest, high-risk mortgages. Analysts indicate that the entire fringe market is growing, and with further growth expected over the next twelve months, I worry that without adequate protections in place, more people will be pushed into the same predatory debt trap that I was pushed into.

A national anti-predatory lending strategy that seeks to harmonize federal and provincial anti-predatory lending practices would help tackle inter-jurisdictional challenges and gaps in regulation on predatory lending, which would help bring spiralling debt costs for many low and moderate-income individuals under control.

Find out more about ACORN’s Fair Banking campaign here.

Donna Borden is a member of ACORN Canada and an ACORN Financial Justice Leader.

Photo: ACORN Canada

Like this article? Please chip in to keep stories like these coming.