When Linda McQuaig and Neil Brooks write their sequel to The Trouble With Billionaires, let’s hope they’ll help us understand why the 1 per cent whine even when they win.

Take Stephen Schwarzman, chairman of one of the world’s largest private equity firms, the Blackstone Group; worth $4.7 billion, Mr. Schwarzman is the 52nd richest person in America. He describes his business philosophy candidly: “I want war, not a series of skirmishes. … I always think about what will kill the other bidder.” He sees Wall Street locked in fierce battle with President Barack Obama which he once described, yes, as a war: “It’s like when Hitler invaded Poland in 1939.”

Mr. Schwarzman eventually apologized for his language — but not for the sentiment behind it. The heinous act that provoked him to compare the U.S. President to Hitler? Mr. Obama’s attempt to prevent billionaires like Mr. Schwarzman from paying tax at a lower rate than Warren Buffett’s secretary.

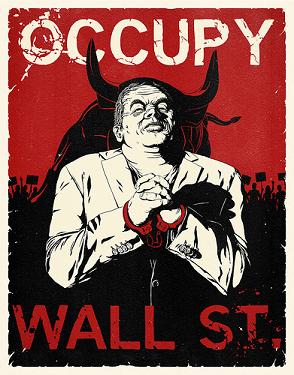

What’s particularly noteworthy here is that despite the success of the Occupy movement in putting inequality on the international agenda, it can safely be reported that just about everywhere, the 1 per cent are still laughing all the way to the bank. In fact they own the bank. Just a little south of here, the Bank of America was bailed out by American taxpayers to the tune of $45-billion. It claimed a pre-tax loss of $5.4-billion and so paid no taxes for the past two years. In one of those years, it dished out executive bonuses and compensation worth $35-billion. Could I make this stuff up?

The bargain between the 1 per cent and the governments of the 1 per cent is clear: huge tax breaks for the big boys, austerity for the 99 per cent. Can you handle more figures? Since the geniuses on Wall Street gave us the great crash of 2008, American banks received $7.7-trillion in bailout money and British banks $1.3-trillion. Yes, trillion, in both cases. To offset those losses to the public purse, the United States will cut public spending by $2.4-trillion in the next decade and Britain $128-billion. In Britain this will include almost half-a-million lost public sector jobs.

It’s time to resurrect the biting formula given us years ago by John Kenneth Galbraith, an earlier generation’s Paul Krugman: private affluence, public squalor.

Canada merely proves the rule. Despite our ever-receding kinder/gentler reputation, Canada is actually becoming more unequal faster than most other countries. There’s an elephant in the room here (as elsewhere) that’s almost always ignored. As economists Sam Gindin and Paul Kahnert report in the April CCPA Monitor, there’s far more wealth in Canada today than ever before. Per capita GDP is 50 per cent higher (adjusting for inflation) than 30 years ago. Yet most of that wealth has been transferred to the richest Canadians through tax cuts and government subsidies.

Since 1980, the ultra-rich have increased their share of the national income from 8.1 per cent to 13 per cent, a shift of $67-billion. Here’s a strange coincidence. The combined federal and provincial deficits now run at about $65-billion annually. So let’s see now. If taxes on the super-rich had stayed at their 1980 level — when no well-heeled Canadian was exactly suffering from cruel and unusual tax torture — there’d be no federal or provincial deficits today. Interesting.

Privileging the few and hurting the less privileged has been very much a non-partisan tradition in Canada, from Brian Mulroney through Jean Chrétien and Paul Martin to Stephen Harper. Between 2000 (Chrétien-Martin) and today, corporate taxes have been reduced to 15 per cent from 29 per cent, but instead of putting their extra profits into productive business investments Canadian corporate leaders have engorged themselves on their $500-billion windfall. Looking at the Harper government record alone, from its first year in office in 2006 to 2013-14, tax cuts will cost the government — that’s us, the citizenry — $220-billion, creating the very deficits that are now used to justify government spending cuts. Interesting.

But if the 1 per cent are still winning the brutal class war, the 99 per cent are not yet surrendering. Portents of hope are everywhere. France, of course. Britain, where the austerity-obsessed Tory-Liberal coalition got smashed in municipal elections last week. The United States, where Mr. Obama is framing Mitt Romney as the candidate of the 0.00001 per cent.

And if you sometimes fear that Occupy was just a dream, look hard and you can still find evidence across the United States of its existence. In fact there are mini-Occupies all over the country — Occupy Colleges, Occupy Our Homes, Occupy the Securities and Exchange Commission, even an Occupalooza organized by Occupy Fullerton, which seems to be a town in California.

In Canada too there’s a revival of protest. Of course most controversial are the Quebec students. But whatever you think of them — and I for one believe their protests have become counter-productive — it’s obvious these young people are amazingly committed and tenacious; that’s the spirit that the 99 per cent need.

Voices-Voix, a non-partisan coalition of civil society groups and NGOs disappointed by the Harper government, is revving up its collective clout against the government. Canada can also now boast of Doctors for Fair Taxation, Lawyers for Fair Taxation and Faith Leaders for Fair Taxation. (Anyone who needs extra motivation should take a gander at Kevin O’Leary’s treatment on CBC TV not long ago of a serene and knowledgeable Tanya Zakrison, a surgeon representing Doctors for Fair Taxation.)

A couple of weeks ago 15,000 protesters demonstrated in Toronto against the McGuinty government’s attack on Ontario’s public-sector workers. Along with ever-lower taxes and an end to government regulation of the corporate world, destroying the trade-union movement has for decades been a key objective of the 1 per cent.

Ontario NDP Leader Andrea Horwath has now accomplished what the majority everywhere are fighting for. She actually forced the minority Liberal government, anxious to avoid an election, to agree to a small surtax for the 23,000 Ontarians who declare earnings of more than $500,000 a year. If I were advising Ms. Horwath, I would mobilize those crusading doctors and lawyers for fair taxation and make equality and fairness my campaign cry in the forthcoming Kitchener-Waterloo by-election.

I don’t think either American or Canadian billionaires have to sell off too many of their private jets just yet. But they shouldn’t be too complacent, either. The rich world is due its Spring Revolutions too.

This article was first published in the Globe and Mail.

Cultivate Canada’s media. Support rabble.ca. Become a member.