Last week my Unifor colleague Jordan Brennan and I published a study through the CCPA Ontario office examining the historical empirical evidence regarding the link between changes in minimum wages and employment outcomes. We find there is no robust evidence in Canadian historical data that increases in real minimum wages cause either lower employment or higher unemployment, even when we focus on key segments of the labour market that are most reliant on low-wage labour (including youth and the retail and hospitality sectors).

The full study, titled Dispelling Minimum Wage Mythology: The Minimum Wage and the Impact on Jobs in Canada, 1983–2012, is available here. It received some decent media coverage, including stories in the Toronto Star, Canadian Labour Reporter, the Huffington Post, and the U.S. liberal news aggregator ThinkProgress. (The latter link includes several other useful links to other progressive research on minimum wage effects.)

The major points of the paper are as follows:

- In reviewing the extensive literature on the minimum wage, there is a persistent indeterminacy on both theoretical and empirical grounds regarding the likely employment effects of changes in the statutory minimum. Theoretically there are plausible arguments going either way: higher minimums might cause disemployment (via capital substitution effects, impacts on the scale of production by minimum wage employers, and other channels). But there are plausible theoretical arguments that the effect might be negligible (since the demand for labour is derived from the demand for the ultimate product which labour produces) or even positive (if we consider demand-side feedbacks on purchasing power from higher wages, or positive impacts from higher minimum wages on productivity and employee retention).

- This ambiguity is also reflected in empirical studies. Many find small negative disemployment effects, many find no significant effects, and some find positive effects. (There are specific references to this extensive literature in our CCPA study.)

- So to consider how this indeterminacy shows up in the real data, we cast a broad, simple, empirical net. We looked at aggregate employment and unemployment data — for each of the 10 provinces, over a three-decade period. We considered a range of different employment and unemployment indicators (seven in total for EACH province). These indicators included overall employment, the employment rate, and the unemployment rate; the youth employment and unemployment rates; and employment in two key low-wage sectors (retail and hospitality). And we asked: given the debates in both economic theory and empirical research about the employment effects of higher minimum wages, are there any disemployment effects from minimum wage changes strong enough to be visible in aggregate labour market data? (And hence important enough that policy-makers should be concerned about them?)

- The answer was a resounding “NO.” We conducted a total of 70 regressions (seven in each province) on data series covering the period 1983 through 2012. In each case we included an appropriate measure of macroeconomic conditions to capture the dominant impact of spending power and product market conditions on hiring decisions. (These demand-side variables were strongly significant in most of the regressions, not surprisingly — since, after all, employers don’t hire workers for their own sake, they hire workers to produce stuff to sell to consumers, so the level of consumer demand is the key variable.)

- In 90 per cent of the regressions (63 of 70), the minimum wage term was not statistically significant in either direction. This indicates that once we have controlled for spending power and demand conditions in product markets (which is why workers get hired in the first place), then the minimum wage is not a significant determinant of employment decisions. Whatever disemployment pressures may result (from capital-labour substitution, or reductions in the scale of business activity by some minimum-wage employers), are offset by other factors affecting employment levels.

- This finding of general statistical irrelevance was also sustained even when we zeroed in on youth employment and unemployment rates, and on employment in the low-wage retail and hospitality sectors.

- Moreover, in the seven cases where changes in the minimum wage proved to be a statistically significant determinant of changes in employment or unemployment, the results were almost evenly split in terms of the direction of the impact. Four cases found a negative impact of higher minimum wages on hiring outcomes (leading to either less employment or more unemployment). But three cases found a positive impact (leading to either higher employment or lower unemployment) — including the youth unemployment rate in Ontario (for which the minimum wage was statistically significant, with a negative sign).

- A detailed description of the methodology of the study, and results for all 70 of the regressions, is provided in the study.

- The key take-away: the level of the minimum wage is virtually statistically irrelevant as a determinant of employment levels in Canada — even in sectors which use minimum wage labour heavily. Macroeconomic and demand-side measures (affecting how much of their output businesses expect to be able to sell) are by far the most important determinants of employment levels. Nor is it credible to argue that raising minimum wages will, in itself, improve employment outcomes. That’s why our progressive jobs vision must also include expansionary demand-side measures (including an end to austerity, ambitious public investment, measures to stimulate business investment and exports, and more) to expand the quantity of jobs, in addition to measures (including higher minimum wages) which boost the quality of jobs.

We hope this study will bolster campaigning for higher minimum wages and living wages. The oft-stated fears of disemployment effects reflect the self-interested arguments of employer lobbyists and others interested in continuing to suppress wage levels in Canada.

Jim Stanford is an economist with Unifor.

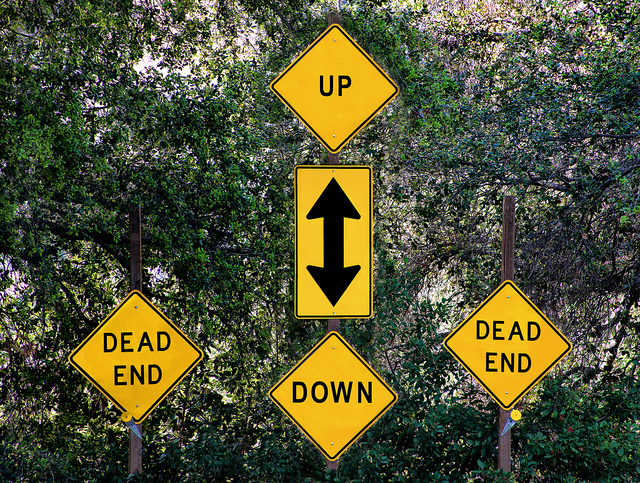

Photo: Russ Allison Loar/flickr