Clearly the entire economics establishment, with about a million people on the planet involved in some aspect of economic analysis, planning, risk management, and forecasting, turned out to be turkeys owing to the simple mistake of not understanding the structure of Extremistan, complex systems, and hidden risks, while relying on idiotic measures and forecasts — all this in spite of past experience, as these things have never worked before.

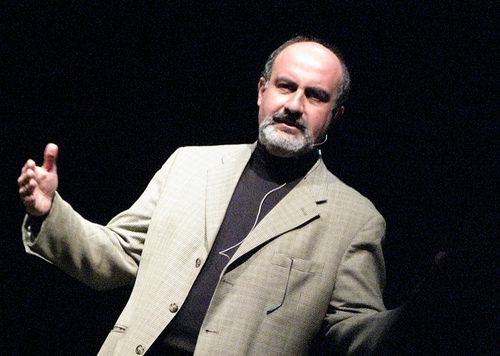

– Nassim Nicholas Taleb

My last column began with a discussion of a philosophical turkey; that is, a steadily fattening fowl who predicts, based on empirical evidence and his delight when offered a free lunch, that life gets better and better. The bird suffers a shift in perspective on the day before Thanksgiving, suggesting that the inductive method may not be flawless. The parable of the turkey comes from Nassim Nicholas Taleb’s book The Black Swan: the Impact of the Highly Improbable (2007, 2010) as an illustration of the tenuous assumptions of predictive models in a world increasingly characterized by volatility. The black swan, as opposed to the projected white swans, represents the incursion of the unexpected. The writer believes that sudden, unforeseen events have more impact on history than the obvious, calculable ones. Taleb, a former derivatives trader, made millions of dollars betting against the neoliberal experts’ representation of the economic system during the most prominent recent black swan — the 2008 financial crisis. He has been the most articulate, engaging and damning critic of top-down decision-making approaches — what he labels “Soviet/Harvard chic” — ever since.

In the column I noted the potentially anti-progressive implications of his analysis. If we cannot anticipate, then we cannot assume that social policy will lead to the consequences that we intend. Historically conservatives had made the argument that unintended results are always far more dangerous than the intended ones. The author of The Black Swan extends this contention across the spectrum to include the decision-making models of bankers, financiers and economists. He believes that there is an increasingly large domain of decisions that cannot be made under transparent circumstances. The final chapter of book titled “On Robustness & Fragility” begins to propose some solutions to our incapacity to calculate in a situation of increasing opacity.

The first principle, or admonition, is that the key method for dealing with the unknown is to make one robust to negative black swans while increasing one’s exposure to positive ones. One example of this concerns his attitude towards debt. Debt increases one’s fragility. He notes that Near Eastern religions always had strict interdictions against owing money because they recognized humanity’s perpetual lack of epistemic humility. Operating under conditions of liability assumes an inaccurately confident degree of predictive capacity.

Second, he advances the claim that the bigger and more interdependent that a system is, the more exposed it is to potential catastrophe. The financial crisis amplified because in a large interconnected system the failure of one bank — Lehman Brothers in September 2008 — brought down the entire system. Taleb does not believe that a company, or any organization for that matter, becomes more efficient as it gets larger; therefore he calls for smaller institutions so that their inevitable confrontation with crisis will not have lethal network effects. The failure of the local tanning salon or aromatherapy clinic does not threaten the economy of the city. We cannot eliminate the unforeseen from economic life through monetary policy, thus we have to assume that crises will occur but can be contained by a system of less grandiose actors.

Third, he points out that we do not often recognize the value of negative advice; that is, “don’t do that” but instead over-emphasize “constructive” proposals. The former are difficult to appreciate because they are dogmas — rules with unpredictable results — whereas the latter are more appealing because they are kerygmas — rules with expected outcomes. Doing nothing can be less harmful than doing something because the latter ignores the possibility that institutions, systems and people operate according to cyclical patterns as opposed to linear ones. Taleb contends that the U.S. government should not have intervened but instead let the big banks fall because the market would have re-adjusted and stabilized over time. The crisis could have been experienced as a vaccination; that is, building up the immunity of the system against greater future calamity. The former trader believes that by bailing out institutions that were deemed “too big to fail” the system perpetuated the possibility of larger, future cataclysm.

Despite his criticisms of the decisions of the economic elite, Taleb’s ultimately conservative bias comes through in his regular denunciations of the New York Times and his entertaining phrase “Soviet-Harvard chic”. The American right-wing loves to censure thoughtful newspapers and universities because the educated are often their most incisive critics. The truth is that a more insightful term would be “Soviet-IMF chic”. Top-down models are not limited to liberals or Bolsheviks. The past generation of IMF policy, financial manipulation and military arrogance has shown us that conservatives, bankers and neo-imperialists are just as happy to pursue ineffective hierarchical paradigms.

Taleb’s work is at its most brilliant when he points out the dangers that centralized forms of decision-making produce. His analysis unintentionally overlaps with the call by egalitarian social movements, and myself in Another World is Possible, for radical democracy; that is, decision-making that is not driven by a vanguard but instead by continuously accessing multiple, diverse sources of information. Unlike Taleb, progressives have faith in humanity’s capacity to solve problems and collectively protect ourselves from unexpected disasters. The crucial difference between him and many on the contemporary left — and this is where I lean to his interpretation — lies in his recognition that intermittent adversity inoculates because it develops resilience. The progressive quest for greater empathy should not overlook the value of the perilous, rugged and unknown.

Thomas Ponniah is an Affiliate of the David Rockefeller Center for Latin America Studies and an Associate of the Department of African and African-American Studies at Harvard University.

Photo: Agathe B/Flickr